Electronics News

Archive : 22 January 2015 год

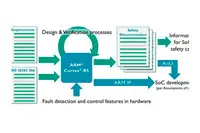

In a move intended to boost adoption of the Cortex-R5 processor in safety critical applications, ARM has delivered a comprehensive safety document set that will allow semiconductor companies to demonstrate their chips are compliant with new functional safety standards.

In a move intended to boost adoption of the Cortex-R5 processor in safety critical applications, ARM has delivered a comprehensive safety document set that will allow semiconductor companies to demonstrate their chips are compliant with new functional safety standards.

Richard York, vice president of embedded marketing, noted: "As long as 20 years ago, ARM cores were being designed into things like braking systems, but the standards then didn't reflect the concept of IP. That has changed in the last few years and industry cares a lot more about safety than it did.

"The document set provides SoC developers with access to additional information required for demonstrating functional safety. Whilst automotive applications (ISO26262) are the main target, the approach will also be applicable in robotics and factory automation, as well as in white goods. "If they go wrong, they can cause problems," York noted.

The Cortex-R5 safety document package supports IEC61508 for industrial applications and generic safety documentation and other markets, including medical, are addressed.

York said the trigger for the move was ISO26262. "But our functional safety manager pointed out that all safety standards have the same core and if we designed our internal processes in such a way, we could address a range of standards."The safety document package also allows OEMs using ARM cores in a safety context to follow an audit trail all the way back to requirements tracing and testing.

Although ARM has decided to roll out safety documentation for the Cortex-R5, York said similar documentation will follow for the Cortex-M and –A processor cores later in 2015.

Author

Graham Pitcher

Source: www.newelectronics.co.uk

The top 10 consumer electronics companies bought $125.6billion worth of semiconductors in 2014, equivalent to 37% of all semiconductor purchases and 9.4% more than in 2013, according to a report from market analyst Gartner.

The top 10 consumer electronics companies bought $125.6billion worth of semiconductors in 2014, equivalent to 37% of all semiconductor purchases and 9.4% more than in 2013, according to a report from market analyst Gartner.

Together, Samsung Electronics and Apple bought $57.9bn of semiconductors in 2014, $3.9bn more than in 2013 and equivalent to 17% of total semiconductor demand. However, whilst the top 10 spenders grew their consumption by 9.4%, Apple and Samsung's combined spend grew by 7.1%.

According to Gartner, the top 10 spenders are:

Samsung Electronics

Apple

HP

Lenovo

Dell

Sony

Huawei

Cisco

LG Electronics

Toshiba

Author

Graham Pitcher

Source: www.newelectronics.co.uk