Electronics News

Archive : 5 November 2014 год

Sales of organic and printed electronics are expected to grow by 19% next year, after climbing an impressive 10% in 2014.

Sales of organic and printed electronics are expected to grow by 19% next year, after climbing an impressive 10% in 2014.

Allied Market Research says the market for organic electronics will grow by 29.5% between now and 2020, propelling the industry to a global worth of $79.5billion.

Also positive about the booming market sector is the Organic and Printed Electronics Association (OE-A), which says 53% of companies are anticipating a 20% rise in sales this year.

What's more, the organisation found that nearly half (47%) are planning to expand production, and around 45% want to take on new staff.

OE-A chairman Dr Stephan Kirchmeyer said: "An increase in sales is a great result for the organic and printed electronics industry – especially since the results are applicable to all areas, from material suppliers to end users, and in all regions: Europe, Asia and the United States."

Author

Laura Hopperton

Source: www.newelectronics.co.uk

Looking to help designers achieve greater efficiency and reduced system size,Toshiba has introduced the first 800V power MOSFET based on its high voltage DTMOS IV super junction technology.

Looking to help designers achieve greater efficiency and reduced system size,Toshiba has introduced the first 800V power MOSFET based on its high voltage DTMOS IV super junction technology.

Sampling now, the TK17A80W utilises the company's single epitaxial process and is suited to equipment that requires high reliability, power efficiency and a compact design. Typical applications include power supplies and adapters, fly back converters and LED lighting equipment.

Compared to multi epitaxial processes, Toshiba's Deep Trench technology is optimised to deliver lower ON-resistance (RDS(ON)) at higher temperatures. It also offers reduced turn-off switching losses (EOSS) than previous generations.

DTMOS IV enables faster switching performance by reducing parasitic capacitance between gate and drain. Typical CISS for the TK17A80W is 1450pF (at VDS=300V, f=100kHz). Maximum ratings are 800VDSS , ±30VGSS and 17A drain current. Maximum RDS(ON) is 0.3Ohm.

Toshiba is due to start mass production of the TK17A80W in the fourth quarter of 2014.

Author

Laura Hopperton

Source: www.newelectronics.co.uk

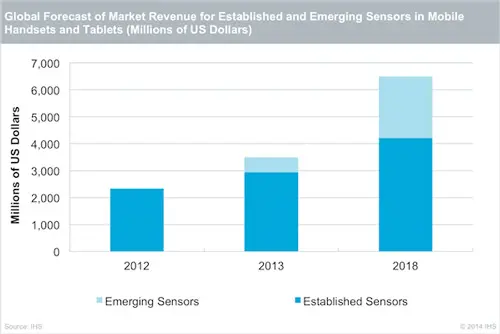

The market for sensors in smartphones and tablets is set to nearly triple from 2012 through 2018, propelled by the race between Apple and Samsung to enhance their mobile products with cutting edge sensor technology.

The market for sensors in smartphones and tablets is set to nearly triple from 2012 through 2018, propelled by the race between Apple and Samsung to enhance their mobile products with cutting edge sensor technology.

According to IHS, worldwide market revenue for sensors used in mobile handsets and media tablets will rise to $6.5billion in 2018, up from $2.3bn in 2012.

The fastest growing portion of the mobile sensor segment will be emerging devices, whose revenue will surge to $2.3bn in 2018, up from just $24million in 2012. In 2013, this segment posted dramatic growth, with revenue rising to more than $500m.

"The next wave of sensor technology in smartphones and tablets has arrived," said Marwan Boustany, IHS senior analyst for MEMS and sensors. "Led by Apple and Samsung, the mobile market is moving beyond simply integrating established devices like motion sensors and now is including next generation features like fingerprint and environment/health sensors. Adoption of these newer devices will drive the expansion of the mobile sensor device market in the coming years."

Established sensors in mobile devices include motion sensors, light sensors and MEMS microphones. Emerging sensors consist of new devices including fingerprint, optical pulse, humidity, gas, UV and thermal imaging sensors.

Apple initiated the market for fingerprint sensors in mobile devices with the release of the iPhone 5s in 2013.

"IHS forecasts that shipments of fingerprint enabled devices will reach 1.4bn units in 2020," Boustany said. "This is more than four times the 317m units expected to be shipped by the end of 2014."

The fingerprint sensor market is beginning to gain traction at other companies outside of Apple, too. New devices with fingerprint sensors include Samsung's flagship model – the Galaxy S5 – and Huawei's Ascend Mate 7, both of which began shipping in 2014.

For its part, Samsung has pioneered the deployment of other devices, including environmental and health sensors in the flagship models introduced by the company during the last 18 months. Samsung rolled out a humidity sensor in the Galaxy S4, a pulse sensor in the Galaxy S5 and a UV sensor in the Note 4.

Fingerprint sensors play a key role in mobile payment services, providing authentication for systems like Apple Pay. Other banks and financial institutions, including Visa, MasterCard and PayPal are also working to support mobile payments and biometric authentication.

"This fingerprint market has all its requirements for success converging at the right time," Boustany noted.

Mobile payment services are expected to gain popularity not just in Europe and North America, but also in Asia.

With the increasing demand for sensor technology in Asia, IHS belives Chinese smartphone OEMs will be the next driver for a new generation of sensors.

Author

Laura Hopperton

Source: www.newelectronics.co.uk